20 Business Deduction 2024 Limit – However, some building improvements now qualify for the deduction. Value limit: All companies that lease, finance or purchase business equipment valued at less than $3,050,000 for 2024 qualify for . For 2024, the employee contribution limit the business in the preceding year in 2023, or $155,000 in 2024, and, if the employer ranks employees by compensation, was in the top 20%. .

20 Business Deduction 2024 Limit

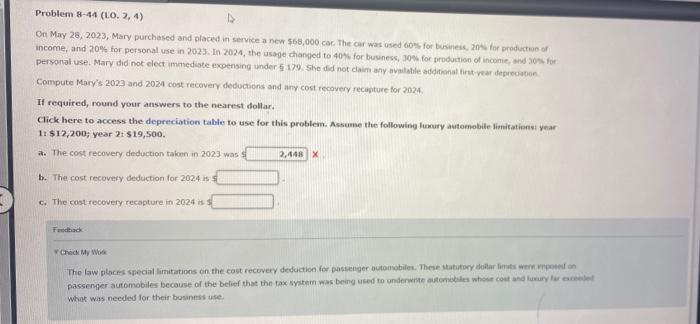

Source : www.columbiathreadneedleus.comSolved On May 28,2023 , Mary purchased and placed in service

Source : www.chegg.comEY Česká republika on X: “In February’s #EY Tax and Legal News

Source : twitter.com2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.orgUS Lending Co. | Redding CA

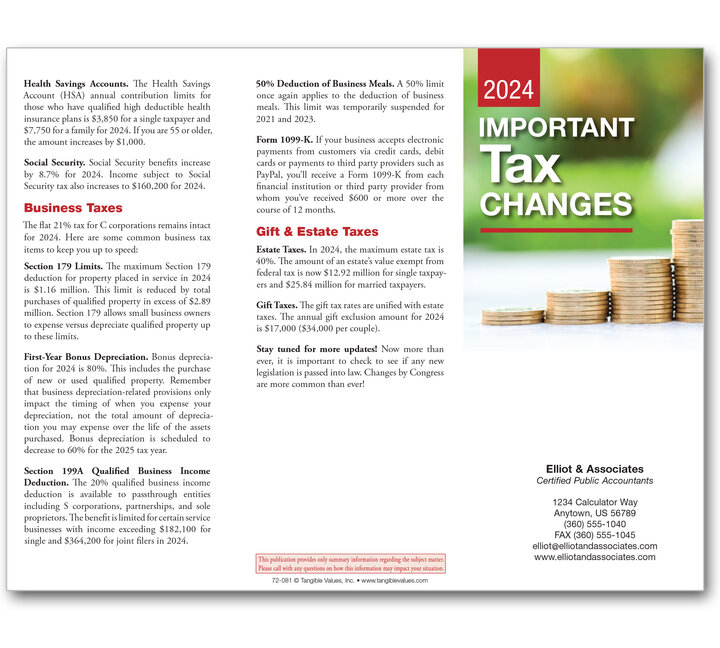

Source : www.facebook.com2024 Important Tax Changes Brochure IMPRINTED (25/pack) Item

Source : www.tangiblevalues.comZ5 Marketing

Source : m.facebook.comElections 2024: Focus On Policy Over Politics | Seeking Alpha

Source : seekingalpha.comMeredith Machinery | LinkedIn

Source : www.linkedin.comSolved income, and 20% for personal use in 2023. In 2024, | Chegg.com

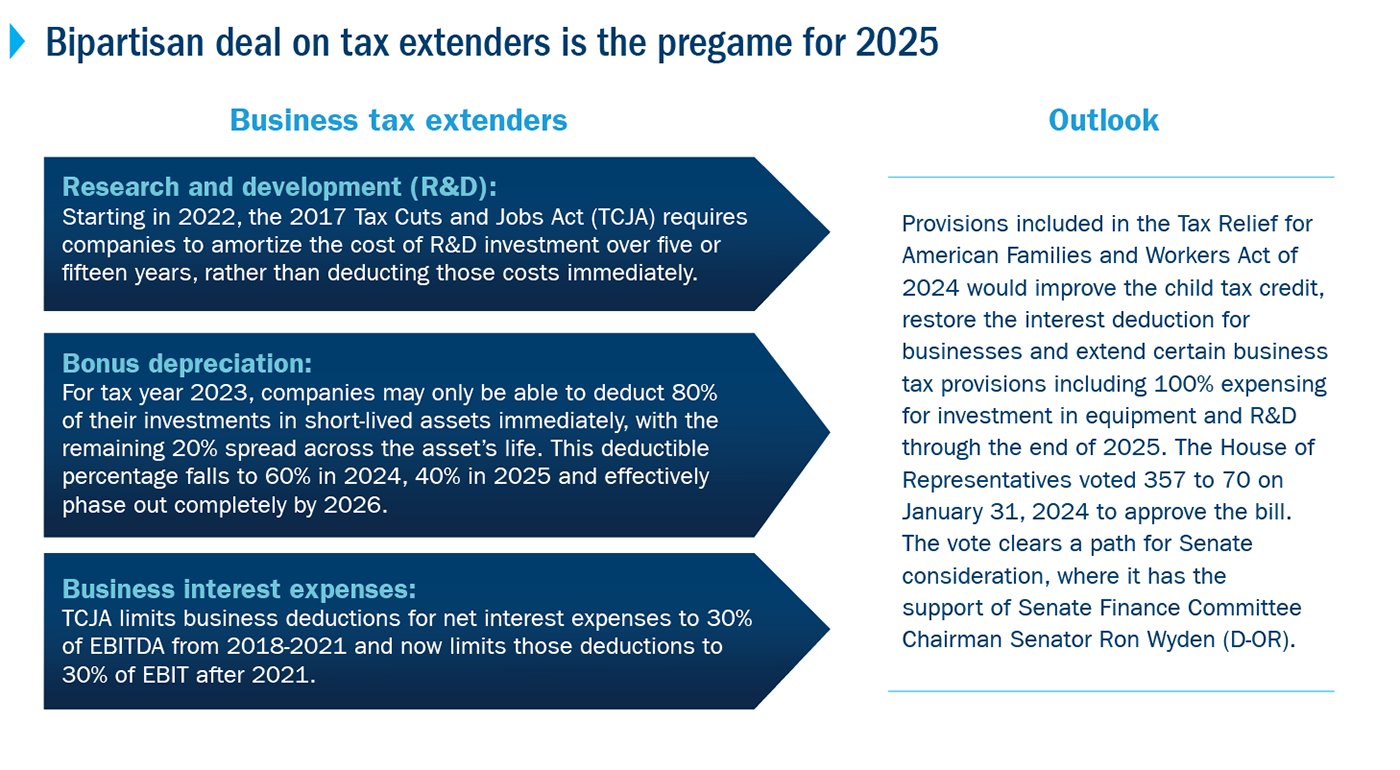

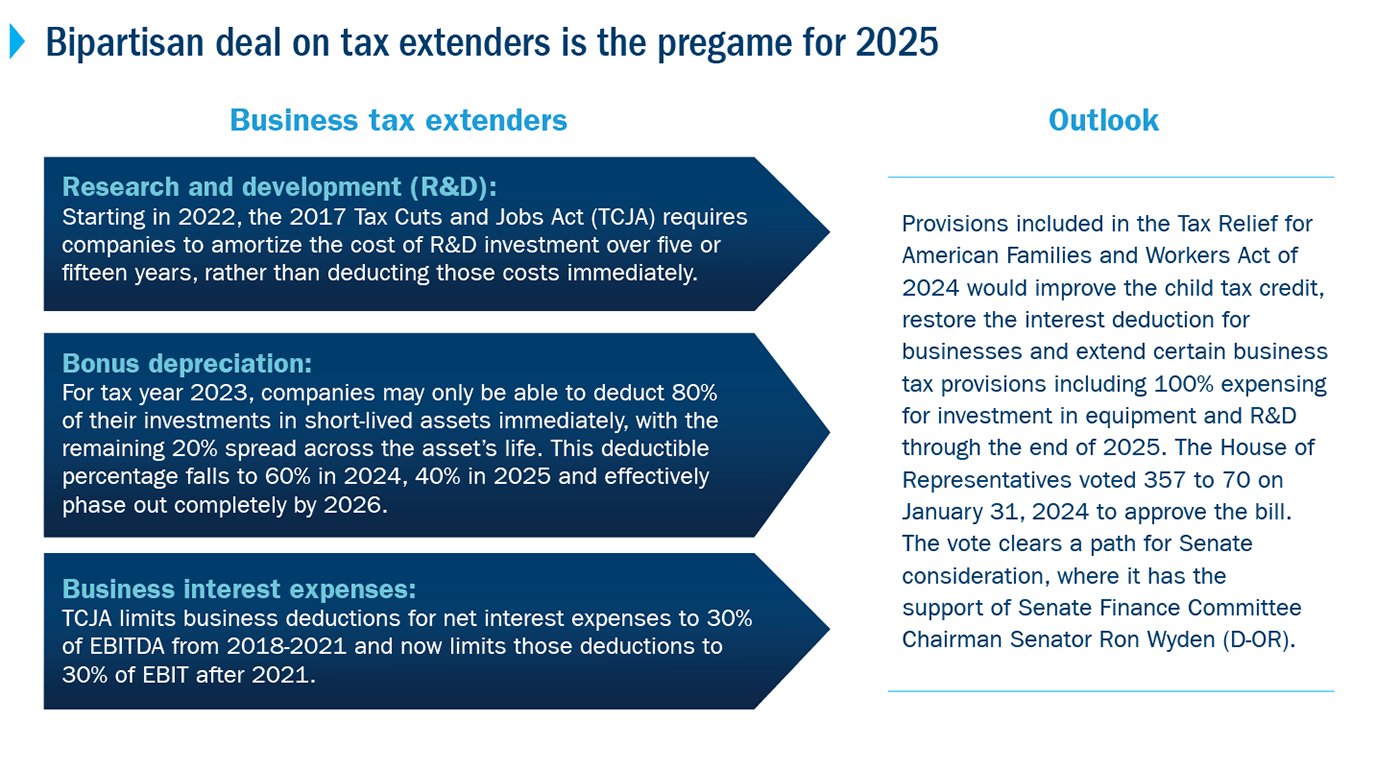

Source : www.chegg.com20 Business Deduction 2024 Limit Elections 2024: Focus on policy over politics | Columbia : The federal government regularly adjusts everything from Social Security benefits to retirement account limits deduction and income brackets, which determine your tax rate. And 2024 will . there is need for the standard deduction limit to be increased from the existing Rs 50,000 to Rs 100,000 per annum. This move will also bring parity with those earning income from business or .

]]>