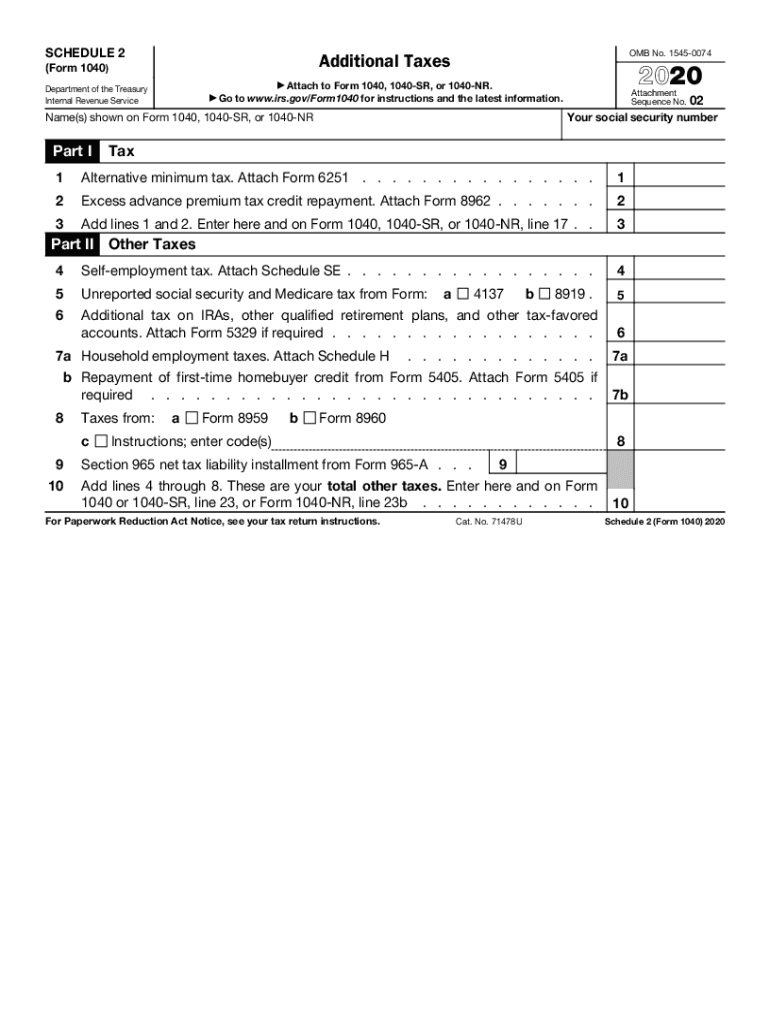

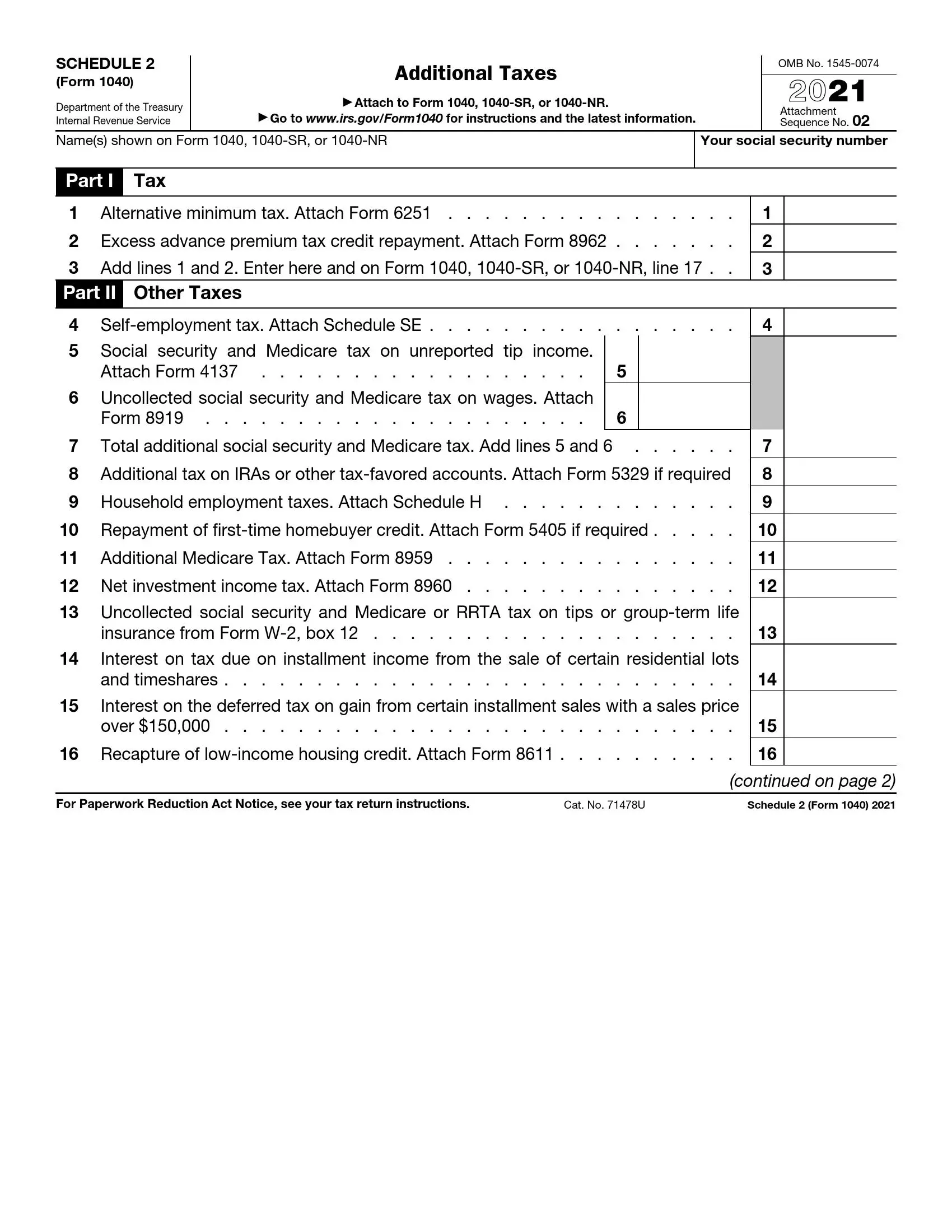

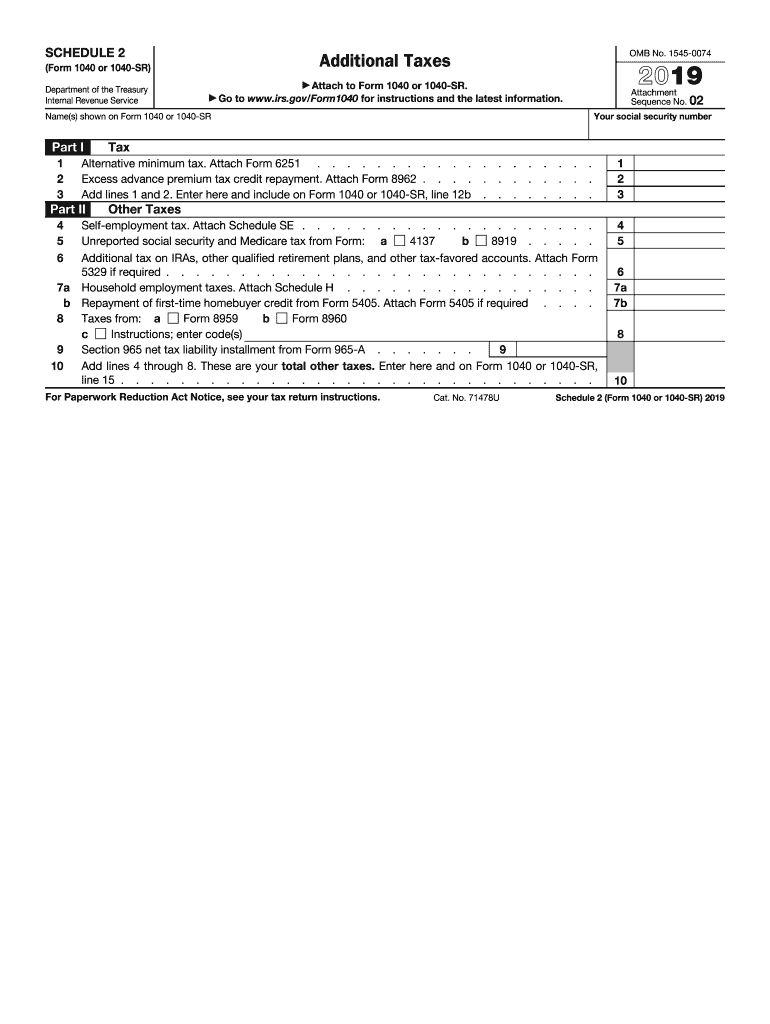

2024 Schedule 2 Form 1040 – Student loan interest deduction worksheet: Found in Schedule 1 of Form 1040, aiding in deduction calculation. 1. Verify eligibility based on IRS requirements. 2. Calculate adjusted gross income (AGI) . According to the IRS, 20% of eligible taxpayers don’t know about the Earned Income Tax Credit, yet it could add thousands of dollars in tax savings back into their pockets. .

2024 Schedule 2 Form 1040

Source : www.nelcosolutions.com2023 Form IRS 1040 Schedule 2 Fill Online, Printable, Fillable

Source : schedule-2-form.pdffiller.comWhere To Find My 2022 Tax Information (2024–25) | Federal Student Aid

Source : studentaid.govWhat is IRS Form 1040 Schedule 2? TurboTax Tax Tips & Videos

Source : turbotax.intuit.comSchedule 2: Fill out & sign online | DocHub

Source : www.dochub.comIRS Schedule 2 Form 1040 or 1040 SR ≡ Fill Out Printable PDF Forms

Source : formspal.comSchedule 2 line 2 fafsa: Fill out & sign online | DocHub

Source : www.dochub.comForm 1040 Schedule 2 Guide 2024 | US Expat Tax Service

Source : www.taxesforexpats.comSchedule 2: Fill out & sign online | DocHub

Source : www.dochub.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov2024 Schedule 2 Form 1040 1040SCHED2 Form 1040 Schedule 2 Additional Taxes (Page 1 & 2 : Enter your COGS in Part I of Schedule C and figure your net profit in Part II. Transfer the result to Form 1040. The IRS gives you an alternative method to account for damaged or stolen inventory. . If all you need is help filing a basic return (Form 1040), here’s the average fee by type of professional: If your situation is more complex and you’re filling out numerous forms to report more than W .

]]>

.png)