Business Use Of Home Deduction 2024 Form – In 2024, you can contribute up to $3,200. Just make sure to use in your home used solely for business. In that case, you may be eligible to deduct expenses like a portion of your rent, mortgage, . The energy efficient home improvement credit can help homeowners cover up to 30% of costs related to qualifying improvements made from 2023 to 2032 .

Business Use Of Home Deduction 2024 Form

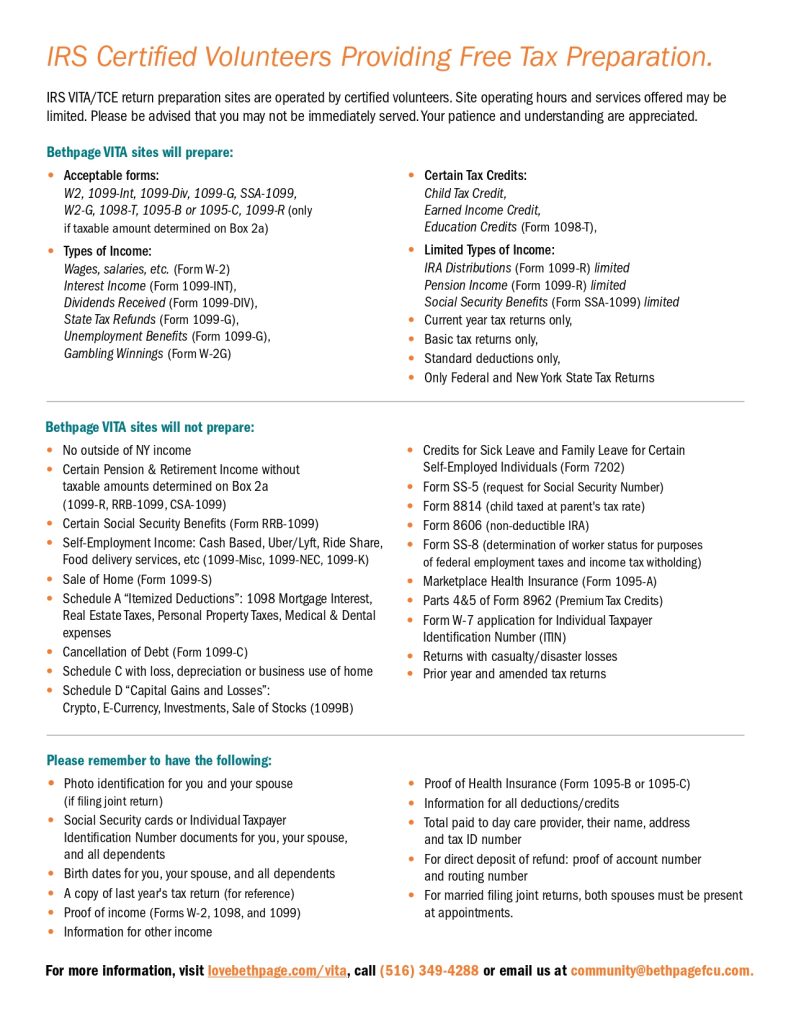

Source : quickbooks.intuit.comFree Tax Clinic Bethpage VITA at Touro Law University – Nassau

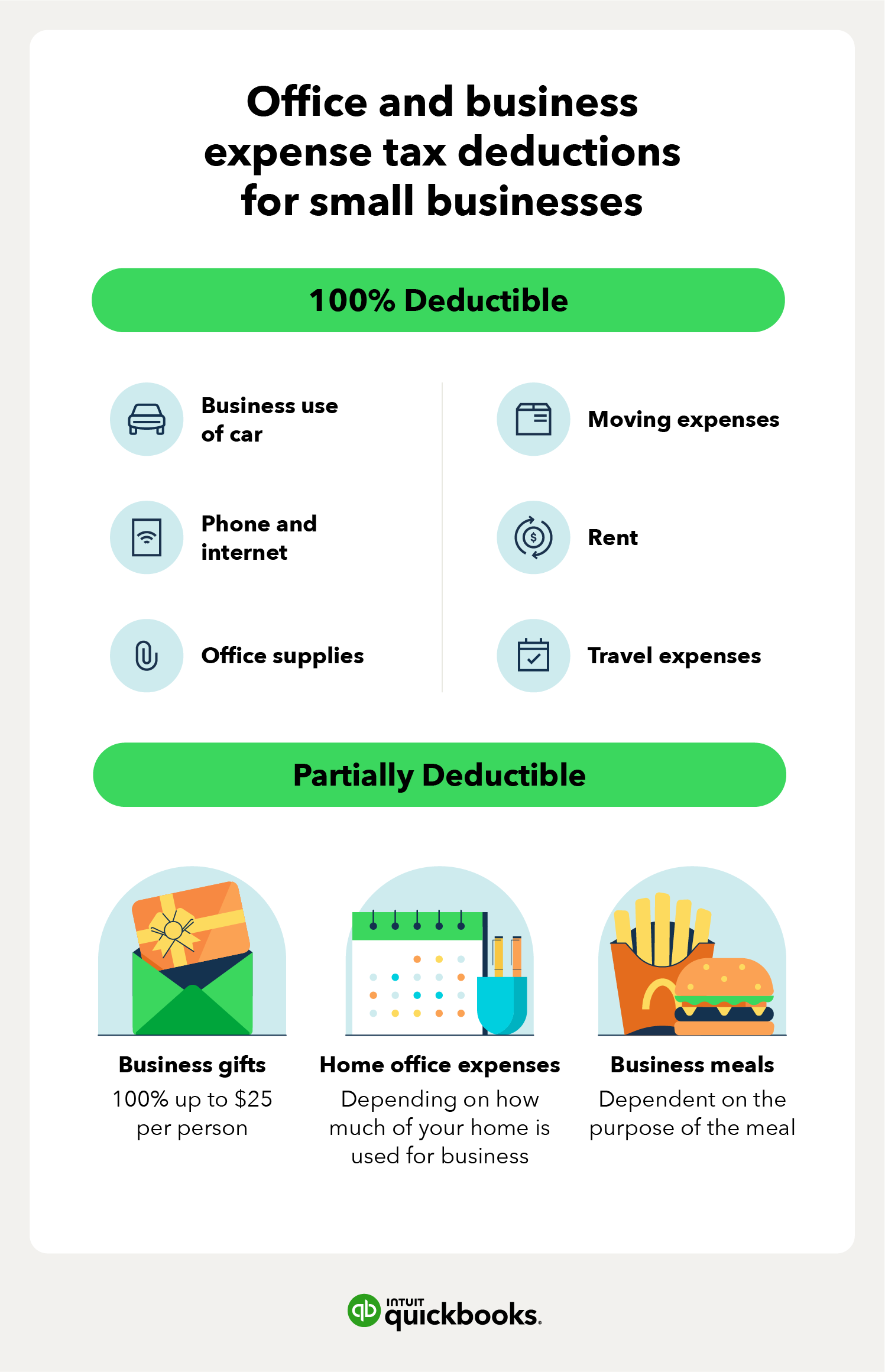

Source : www.nslawservices.orgSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.com25 Small Business Tax Deductions To Know in 2024

Source : www.freshbooks.comForm 2106: Employee Business Expenses: Definition and Who Can File

Source : www.investopedia.comW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov2024 Tax Brackets: IRS Reveals New Income Thresholds | Money

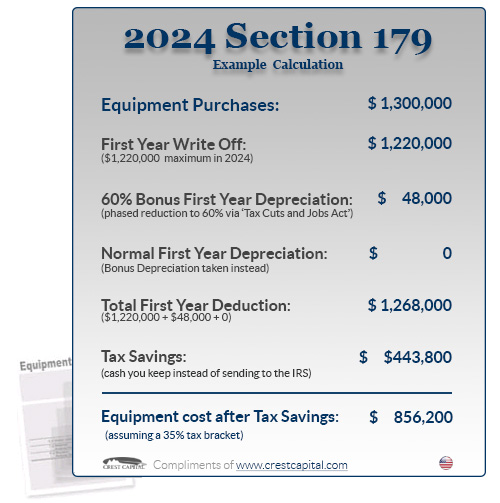

Source : money.comSection 179 Deduction – Section179.Org

Source : www.section179.orgThe Ultimate 2024 Tax Deductions Checklist for Insurance Agents

Source : blog.newhorizonsmktg.comBusiness Use Of Home Deduction 2024 Form Small Business Expenses & Tax Deductions (2023) | QuickBooks: Let’s compare 2023 to what we know about 2024 so far, and take a guess. The pandemic economy caused home deduction increased even more, in percentage terms. Total net assessed value for all . If you bought your first home in 2023 or refinanced your home, then you might be in line to take advantage of some home buyer tax deductions that will be able to deduct some if you use part of .

]]>

:max_bytes(150000):strip_icc()/Screenshot2024-01-12at4.04.42PM-6ae67168a2a848849de8750450dab1af.png)